How Processes Automation Transform Due Diligence?

10.07.2023

What is due diligence? It is a complex process that involves comprehensive research, analysis, and investigation before entering into a business transaction or making important decisions. It is critical to properly assess the risks, opportunities, and potential liabilities associated with a particular venture.

Due diligence also ensures that businesses have a clear understanding of the market landscape and circumstances and can make informed decisions based on accurate information. Failing to conduct due diligence can result in financial loss, legal complications, reputational damage, etc.

That is why there has been a significant shift towards automation due diligence in recent years. Such technologies are revolutionizing the way businesses conduct this process, offering numerous benefits such as improved efficiency, enhanced accuracy, decreased human errors, and faster turnaround times.

In this article, we will delve into the concept of due diligence, its importance in the business landscape, and the increasing trend toward automation. We will also explore the advantages of automating due diligence processes and discuss the key components involved. Additionally, as a Microsoft Certificated Partner, we will discuss the role of Microsoft technologies in enabling effective due diligence automation.

What Is Due Diligence Automation?

The concept of due diligence appeared in 1933, during the Great Depression, when there was a need to be more careful before investing in specific securities. The investor was entitled to receive as many financial documents as possible for verification.

To this day, due diligence meaning has stayed the same: the essence is to conduct inspections and analyses to determine the reliability of the counterparty before carrying out a transaction or concluding an agreement. However, conditions and scales have changed significantly.

Automated Due Diligence

Today, due diligence is a very complex, time-consuming, and expensive process that requires collecting and processing huge amounts of information. And the data, in turn, are constantly changing and growing in numbers. Undoubtedly, such a load can lead to incorrect assessment of risks, human errors, and lost opportunities.

This is where automation comes into the picture. It is impossible to manually check and collect such a huge amount of rapidly changing data. However, with the help of specific technologies and tools, this process can be significantly accelerated and adjusted to the ideal. Artificial intelligence (AI) and automation in due diligence help auditors process data and visualize all the necessary results in a matter of minutes.

So the main idea behind automation is that certain tools and technologies can enhance due diligence efforts by reviewing documents faster, more efficiently, and without human error. They can filter and extract value from volumes of raw digital information, sorting through millions of data points in seconds and providing complete data coverage.

Benefits of Automating Due Diligence Processes

First of all, automated due diligence can significantly improve the efficiency and performance of the process. It eliminates manual, time-consuming tasks, reducing the time and effort required for assessment and checking.

Second, automation in due diligence is a great way to enhance accuracy highly by minimizing human error risk and ensuring data processing consistency. Algorithms and predefined rules can be implemented to standardize data interpretation, leading to more reliable due diligence outcomes.

There are also some other advantages automation brings to the table.

- Faster turnaround times. It streamlines the entire due diligence process, enabling more rapid data collection, risk assessment, and report generation. This allows organizations to make timely and well-informed decisions, gaining a competitive advantage in dynamic business environments.

- Comprehensive data analysis. By leveraging advanced algorithms and machine learning capabilities, automation can uncover valuable insights, identify patterns, and detect anomalies more efficiently than human and manual methods.

- Compliance. Organizations can stay updated with changing regulations by implementing compliance checks and validation processes. This reduces the risk of non-compliance, regulatory penalties, and reputational damage associated with inadequate due diligence.

Have questions about how due diligence automation helps to achieve compliance? Check out our case study for more info on this topic!

- Cost savings. Automating due diligence processes can result in cost savings by reducing the need for manual labor, minimizing errors, and optimizing resource allocation. Additionally, it eliminates the costs associated with paper-based documentation, storage, and retrieval.

- Consistency, flexibility, and scalability. Automation allows organizations to handle increasing volumes of due diligence tasks without compromising quality. Standardized processes and predefined rules ensure consistency in data analysis and reporting across multiple projects or transactions. At the same time, the system allows you to change and configure the check parameters without any extra effort. Automated due diligence software can even automatically update the rules depending on the latest changes in the legislation.

- Paths to growth and future-proofing. Automation helps identify insights and opportunities for development. It also keeps organizations up-to-date with evolving digital technologies and changing priorities in due diligence. Companies can stay ahead of the competition and adapt to future upgrades.

As you can see, the importance of automation in due diligence is difficult to overestimate. Among other things, an automated platform provides reliable and consistent support, helping organizations overcome challenges and allowing human teams to quickly analyze outputs and make informed decisions based on comprehensive insights.

Challenges and Considerations

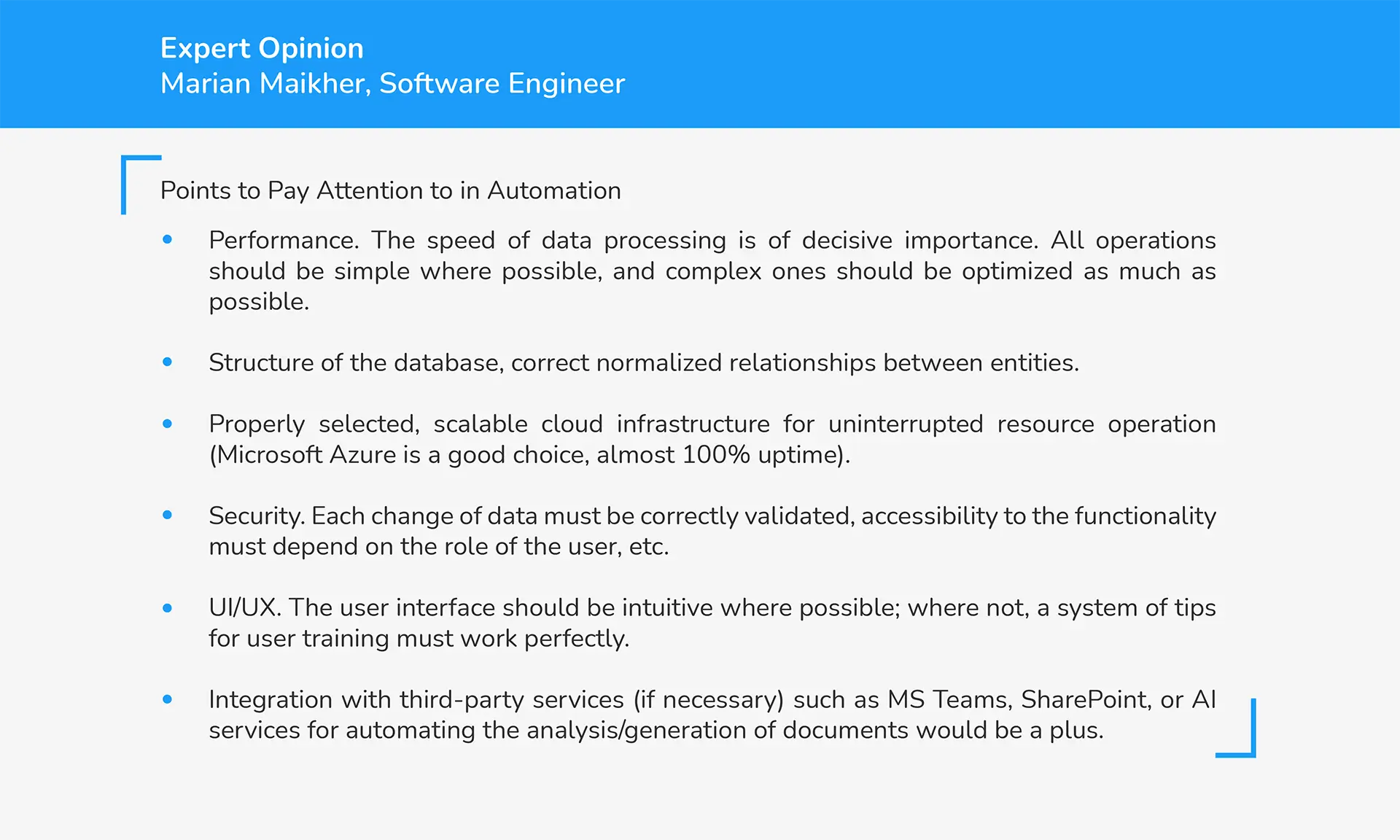

State-of-the-art technologies solve many issues but cannot completely replace a person, especially in complex processes like due diligence. Human experience and judgment are still crucial.

AI knows how to speed up due diligence, but human decisions play a decisive role. Specific nuances, contextual understanding, and subjective judgments may require human intervention. It’s important to find a balance between automation and human involvement, using automation to perform repetitive tasks and freeing up professionals to focus on high-value analysis and decision-making.

In addition, implementing due diligence automation solutions involves integration with existing systems, databases, and workflows. It is critical that the development team can ensure full compatibility and integration with other tools and platforms, given the required scalability and needs to accommodate growing data volumes and expanding due diligence needs.

Also, ensuring that the solution complies with applicable laws, regulations, and industry standards is extremely important when automating these tasks. This may include the involvement of legal expertise and continuous monitoring and updating of the automation system to meet new requirements.

Key Components of Due Diligence Automation

When it comes to due diligence, different processes may require automation. It all depends on the organization’s scope and specific business needs. In some cases, it is necessary to automate the due diligence questionnaire process; and it is worth paying more attention to regulatory requirements and tax audits in others.

However, several key components of this process are worth paint special attention to. They play a crucial role in streamlining and enhancing the efficiency of the overall workflow.

Data collection and analysis

Automation enables the seamless collection of huge amounts of data from various sources, both internal and external. Advanced algorithms and machine learning techniques can be useful in analyzing this data, uncovering patterns, and extracting valuable insights.

Automating data collection and analysis means that due diligence teams can save significant time and effort while ensuring a more comprehensive and far-sighted assessment.

Risk assessment and compliance

The simplified due diligence definition is an assessment process that includes evaluating potential risks and ensuring compliance with regulations and legal requirements. Automation streamlines the risk assessment process by applying predefined rules and algorithms to identify red flags and anomalies.

It can also integrate compliance checks to ensure industry standards and regulations adherence. Automating these processes allows businesses to manage risks more effectively and avoid costly penalties.

Document management and organization

The larger the organization, the more difficult it is to deal with huge amounts of documentation, such as contracts, financial statements, and legal records. An automated due diligence system provides fast and accurate document management and ensures efficient storage, retrieval, and categorization of different types of documents.

Moreover, automation in due diligence can provide secure and convenient access to needed documentation for the company’s employees, simplifying workflows. Intelligent algorithms can extract relevant information from documents, enabling quick access and analysis. Automated document management enables due diligence teams to quickly locate and review critical information, improving overall productivity.

Reporting and visualization

Effective and timely reporting is essential for communicating due diligence findings to stakeholders. Automation facilitates the generation of comprehensive reports with accurate data, visualizations, and insights.

Automated reporting tools help employees to perceive complex data faster and present information in a clear and visually appealing format. This, in turn, allows for making it easier for stakeholders to understand and make informed decisions.

So, as you can see, such components can help streamline due diligence processes, enhance efficiency, and improve decision-making capabilities.

Key takeaways

Data collection and analysis

- Seamless collection of data from various sources

- Advanced algorithms for analysis and insights

- Time-saving and comprehensive assessment

Risk assessment and compliance

- Application of predefined rules and algorithms

- Advanced algorithms for analysis and insights

- Identification of red flags and anomalies

- Integration of compliance checks

Reporting and visualization

- Generation of comprehensive reports

- Accurate data, visualizations, and insights

- Easy data understanding and informed decision-making

Document management and organization

- Efficient storage, retrieval, and categorization

- Quick access and analysis of relevant information

- Improved productivity and workflow simplification

We at devspiration have valid expertise in process automation. It doesn’t matter whether you need to automate the updating and control of the technical due diligence checklist or to ensure the accuracy of a tax audit; we will find an effective solution for you.

Microsoft Technologies for Due Diligence Automation

As a Microsoft Certified Partner, we have extensive experience in using these technologies and making the most of them, starting with creating data rooms for due diligence and ending with the automation of compliance processes.

Microsoft offers many tools that you can use to automate due diligence. Let’s look at the most common options.

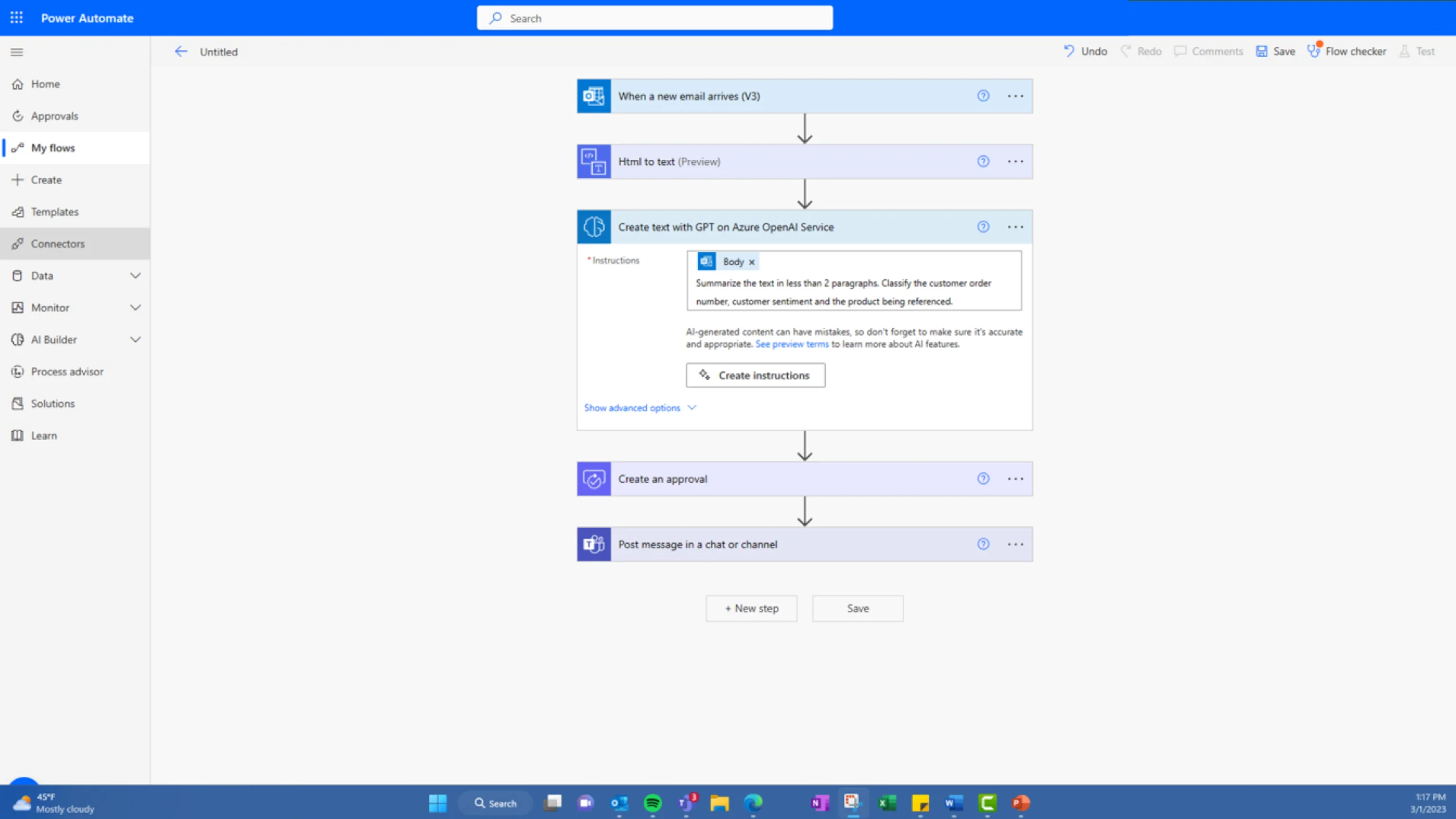

Microsoft Power Automate

Microsoft Power Automate is a low-code platform that is used to automate workflows and simplify data collection, document analysis, and reporting in the due diligence process.

This technology makes it easy to automate repetitive tasks thanks to hundreds of ready-made connectors, thousands of templates, and AI support. It also helps improve efficiency and allows you to embed powerful language models and create unique scenarios through access to the AI capabilities of AI Builder.

According to the Forrester study, Microsoft Power Automate helped reduce errors by 27.4% through increased automation, generated $14.25 million in benefits through streamlined business processes and development, and reduced application development costs by 45%.

Microsoft Azure Cognitive Services

Microsoft Azure Cognitive Services are pre-built AI models that can be used for document processing and recognition, natural language processing, and data analysis, increasing the efficiency and accuracy of due diligence.

All that is needed to access the capabilities of the technology is an API call, and the software receives the functionality to search, understand and accelerate advanced decision-making.

Most often, Azure Cognitive Services is used to build software for mergers and acquisitions (M&A) audits that require a lot of documentation work and attention to detail. Technology helps create a solution that allows lawyers, auditors, and investment bankers who coordinate sales to reduce review times and move deals faster.

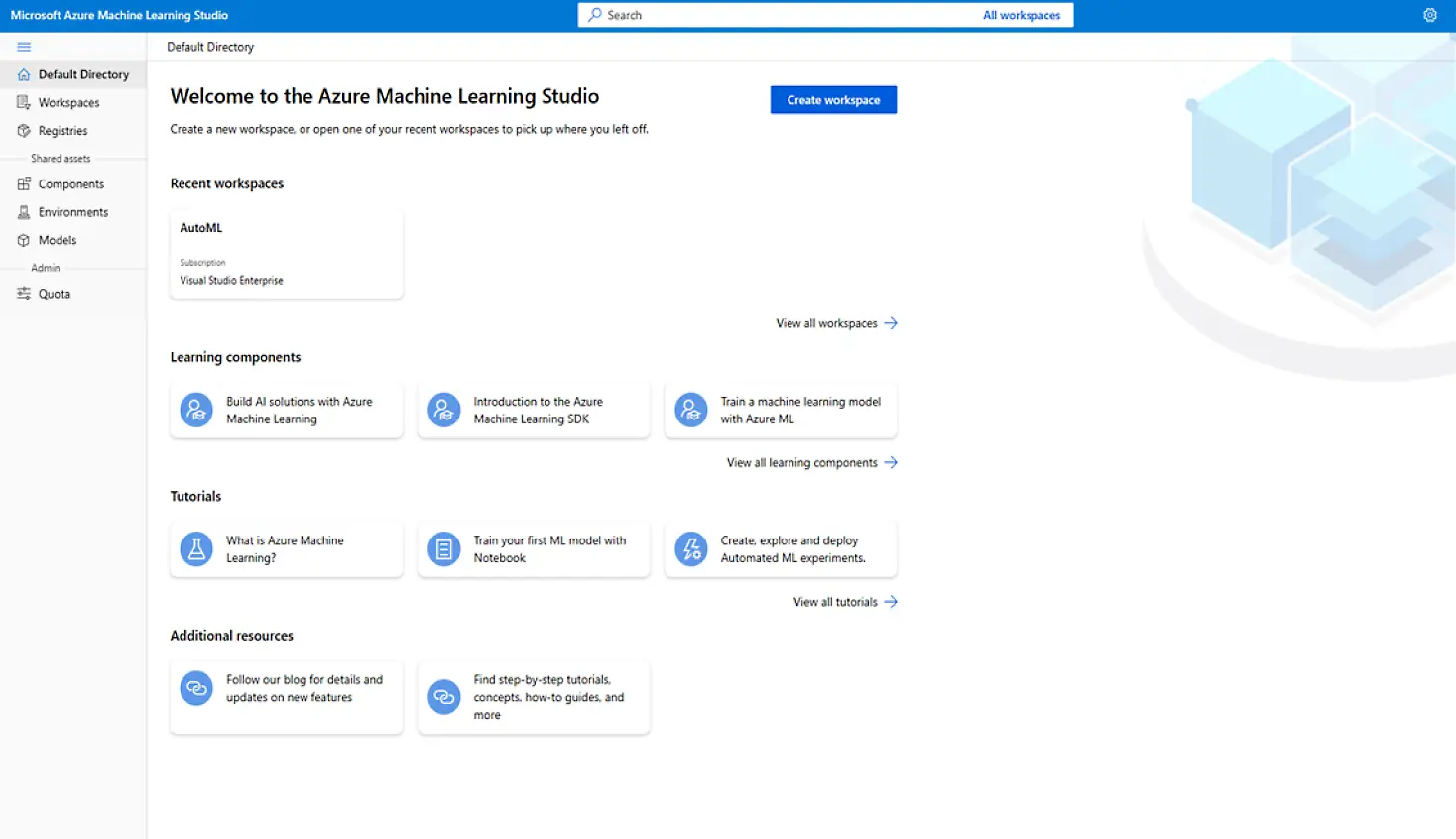

Microsoft Azure Machine Learning

Microsoft Azure Machine Learning is a cloud-based platform that provides tools and services for building and deploying machine learning models. It can be used to develop predictive analytics models to assess risk and automate due diligence decision-making processes.

This technology allows developers to create, deploy, and manage high-quality models faster. It also provides management and sharing capabilities for interaction between workspaces and MLO.

Microsoft Azure Machine Learning uses responsible artificial intelligence to build insightful models using data-driven solutions for transparency and accountability.

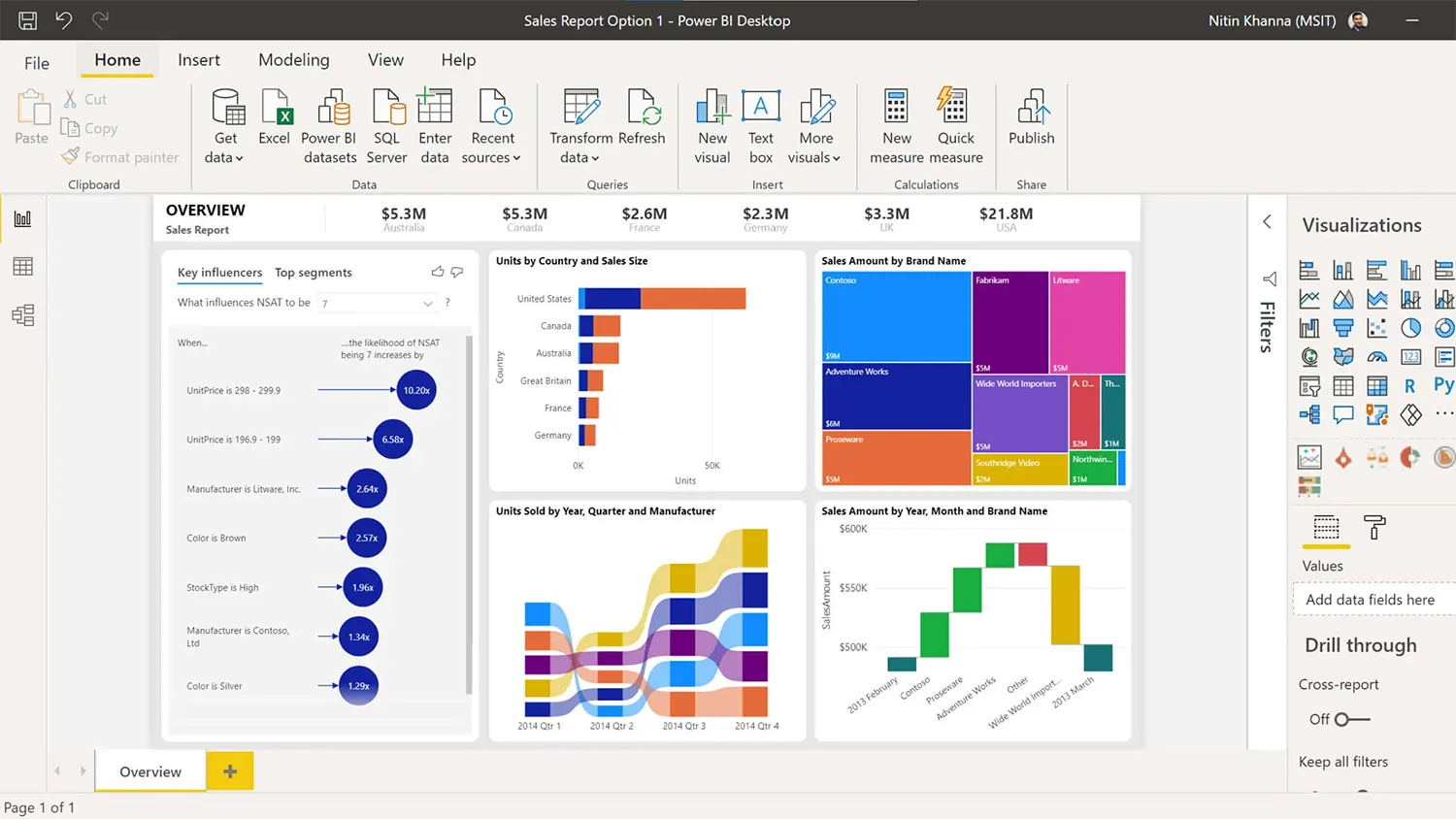

Microsoft Power BI

Microsoft Power BI is a powerful business intelligence tool that allows users to visualize and analyze data from various sources. It can be used to create interactive dashboards and reports, providing valuable information for proper analysis and reporting, which is essential for automated due diligence software.

The technology allows access to next-generation AI tools with Copilot in Power BI. Users can simply describe the statistics they need or ask questions about specific data. Copilot will analyze and select the information they need in the report and turn the data into practical statistics.

Microsoft Power BI is also useful in cases where it is necessary to centralize data in a reliable and secure center and create an accessible single source of accurate data for all employees.

In 2023, Microsoft Corporation, also thanks to Power BI, took the leading place in the Gartner Magic Quadrant for analytics and business intelligence platforms.

Microsoft SharePoint

Microsoft SharePoint is a collaboration platform offering document management capabilities, centralized storage, version control, and secure access to due diligence documentation. This facilitates effective collaboration between team members involved in the due diligence process.

Among the main functionality that the platform gives access to are:

- the ability to share content, knowledge, etc., and manage them to improve teamwork;

- seamless collaboration and communication within the organization;

- powerful search and intelligent ways to find information, experience, and insights to inform decisions and guide action.

This is a great tool for working with data and creating secure document sharing within an organization.

Here is one of the examples of how we use Microsoft technologies to create a successful and scalable due diligence platform. Feel free to check it out!

Future Trends in Due Diligence Automation

The main trends in due diligence automation are related to three primary aspects:

- the use of AI tools (especially in automated technical due diligence);

- document management;

- working with data, their structuring, and safe sharing.

All further due diligence procedures will be conducted remotely and on specialized automated platforms. Therefore, companies in this area should consider developing complex end-to-end solutions.

Another trend is fully automated data collection, analysis, and risk assessment using advanced analytics, machine learning, and artificial intelligence tools. These technologies will be used to quickly extract relevant information from huge amounts of unstructured data (contracts, financial reports, etc.) using natural language processing (NLP) algorithms.

As for document management, the future certainly lies in the full digitalization of this process. Real-time access, version control, and audit logs are also worth paying attention to. Cloud platforms will be described as secure file exchange and data-sharing systems.

Final Thoughts

Due diligence automation is a crucial tool in the business landscape. It has revolutionized the way organizations conduct comprehensive research, analysis, and investigation. Automation streamlines the entire due diligence process, from data collection and analysis to risk assessment and compliance, document management, and reporting. Custom due diligence tools can help to make well-informed decisions, stay updated with changing regulations, and adapt to future upgrades, ultimately leading to growth and future-proofing.

Microsoft technologies provide powerful solutions for due diligence automation. For example, Microsoft Power Automate simplifies workflows and data collection, while Microsoft Azure Cognitive Services enhances document processing and recognition. Microsoft Azure Machine Learning enables the development of predictive analytics models, and Microsoft Power BI offers powerful visualization and analysis of data.

As you can see, due diligence automation is a transformative approach that empowers businesses to make informed decisions, mitigate risks, and optimize their operations. It helps stay ahead in a dynamic and competitive business environment.