Guide On Hiring Fintech Consultants: Checkpoints And Pitfalls

05.06.2023

Discover the essential checkpoints in hiring fintech advisors. Get expert insights and guidance for your fintech product.

Fintech is a fascinating and promising but very complex and competitive industry. The expertise and guidance of fintech consultants have become increasingly crucial for businesses aiming to thrive and innovate.

In this article, we discuss the significance of consultants in the fintech industry and explore why they are in such high demand. Whether you are a financial institution, a fintech startup, or a company looking to integrate financial technology solutions, understanding the role and value of fintech advisors is essential.

So, let’s explore the critical things and pitfalls of hiring fintech consultants to help you navigate this complex process effectively.

Why Are Fintech Consultants In-demand?

According to ReportLinker’s Financial Services Global Market Report 2023, despite the Russian invasion of Ukraine, the sanctions it entailed, and its dramatic impact on the world economy, the global financial services market will grow from almost $26 billion in 2022 to $28 billion in 2023 at a CAGR of 8,8%. Experts expect it to grow to $3,5 billion in 2027 at an average annual growth rate of 7,5%.

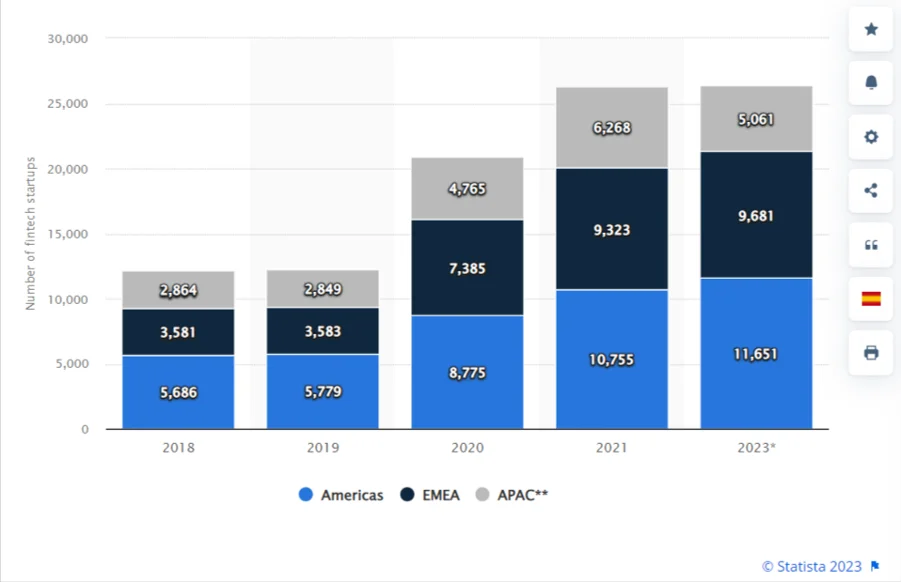

Statista research shows that in 2019 75% of consumers globally have adopted some form of fintech products, mostly money transfer and payment service. And in May 2023, there were more than 11,000 fintech startups in the Americas, more than 9,000 in the EMEA region, and more than 5,000 in the Asia Pacific region.

What does it mean? The fintech industry is incredibly successful and has a wide range of development areas – banking, insurance, lending, investing, etc. However, it is also incredibly competitive and complex. Fintech provides many opportunities for product development, evolution, and profitability, but at the same time, its existence in this industry requires a unique approach, extensive expertise, and insights.

This is where fintech consulting companies come into the picture. They have enough experience in this highly competitive industry and, most importantly, a reliable dedicated team of developers and business analysts team with expertise in the fintech niche you need and a unique perspective on the product, its capabilities, and strengths.

How Can Fintech Consultants Help My Business?

A fintech advisor is a tech and business expert who perfectly understands the field, knows its trends, obvious and non-obvious rules of the game. Fintech advisory services depend on each specific company: its precise needs, scale, technical capabilities, niche, budget, etc.

That is why the consulting firm not only shares insights but also advises on the decision’s relevancy, assesses the general state of your product and business, and identifies risks and ways to overcome difficulties.

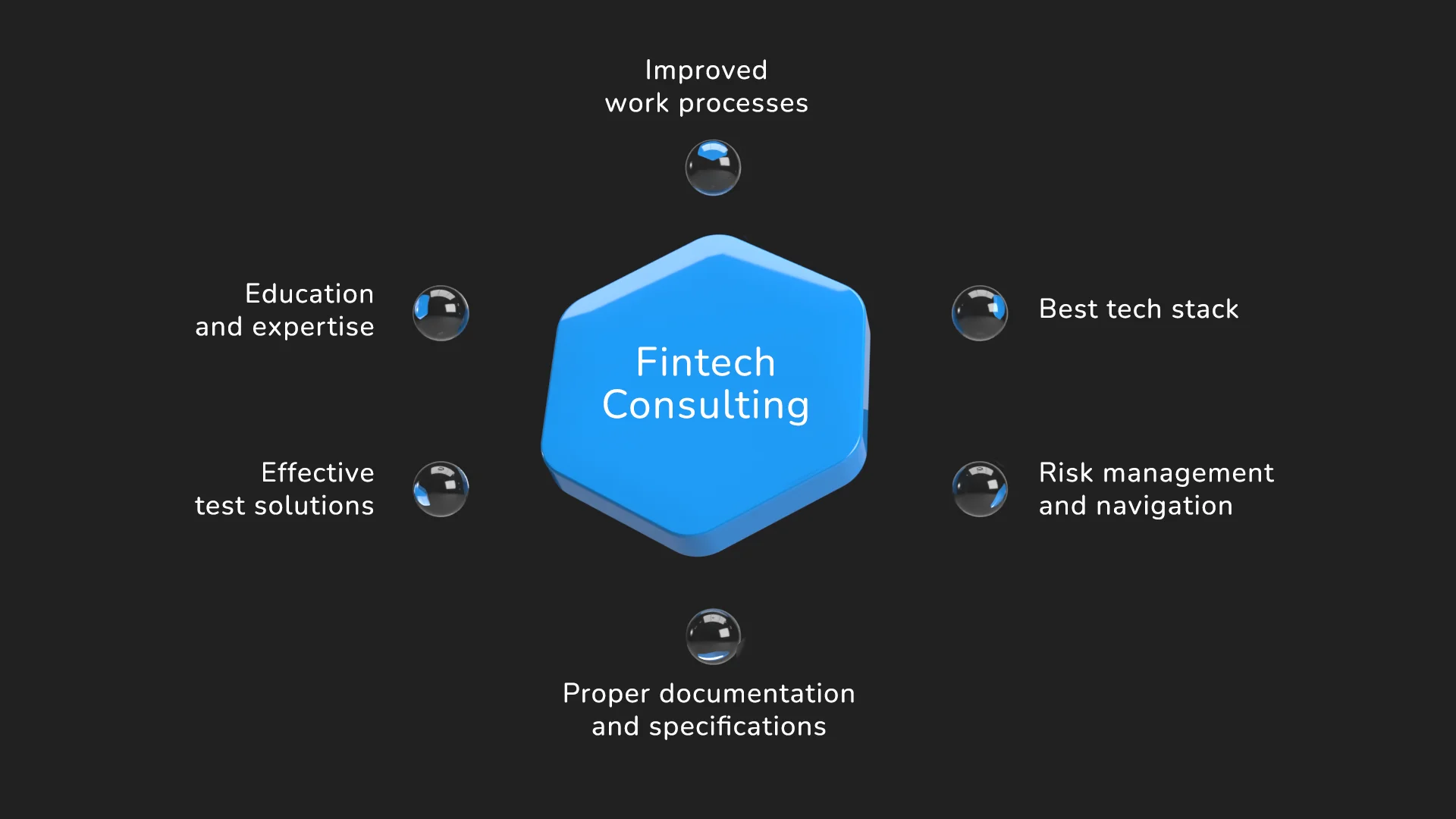

Let’s take a look at some of the most common benefits fintech consultant specialists can bring to your business.

- Education and expertise. Right fintech consultant identifies the weak points of your staff and helps improve their knowledge and education, which in turn leads to the transition of the business to a new level of innovation and the adoption of new technologies.

- Adjustment of work processes following the most effective methods. Very often, the cause of downtime in developing fintech products is poor coordination between sub-teams and the wrongly chosen development methodology. The consulting company can help solve this issue using its own experience and research results.

- Choosing the right tech stack. This not only helps to create a strong competitive solution but also to simplify the future hiring process and gain extensive scalability.

- Risk management and navigation. A deep understanding of the fintech landscape, its potential changes, fast-moving trends, and market changes allows consultants to create an effective wealth management strategy for you.

- Documentation and specifications. Creating proper Software Requirements Specifications (SRS) and other development documents or guidelines is also a part of fintech consulting. It helps estimate the time and cost of product development correctly, saves resources, and simplifies the team’s work.

- Effective test solutions. The consulting team can deeply research your product and market and, based on this, provide you with a list of the best features and optimal testing methods. It helps immediately meet the target audience’s needs and get into the client’s pain points.

- Effective budget management. Financial technology consulting help to estimate, determine the budget, and choose priority areas of work.

Also, fintech consultants can assist companies with digital transformation, a painless transition to new solutions and forms of existence, integration of financial technologies, changes in structural hierarchies, etc.

In general, these are indispensable fintech companies helpers, as they allow you to reduce costs, strengthen the development team, and, most importantly, successfully navigate the industry’s stormy sea, knowing the risks and pitfalls in advance and having an effective strategy to deal with them.

Read also the article by our engineers Azure App Configuration vs. Key Vault

Things To Look For In A Fintech Consultant

Of course, all fintech companies have different goals and development directions. Let’s look at the most common things worth considering when choosing a fintech consultant.

Expertise

The main reason to hire fintech consultants is the lack of expertise and deep understanding of the fintech market. So, first of all, your financial technology consultant should have extensive expertise proven by customer reviews and a portfolio of successful projects.

Check our portfolio and case studies to verify our expertise and the success of our approach

Background

Experience developing fintech solutions is essential, but you also need a reliable partner because you must trust the advisor. Your consultancy agency should definitely have a positive background and a secure approach to handling client data.

Fresh perspective

The fintech market is fast-changing and competitive, so you need an advisor who can provide a fresh view and holistic vision of your goals, integrating new ideas into your strategy.

Specific niche

To address the specific challenges faced by the company, you need to find financial consultants with particular expertise in your industry. While your in-house team may handle common challenges, having an experienced specialist is essential to explore new opportunities. So make a list of specific requirements, questions, and technologies.

Communication

Flexible communication is critical for successful fintech consulting. In most cases, you need to build long-term partnerships with such partners, so ensure you are on the same page and have a clear list of communication channels. This ensures that you get regular updates and periodic insights.

We provide a wide range of fintech services, and we know how important communication is.

Book a demo with us to get to know more about our collaboration approach

Where To Find A Fintech Consultant?

There are various places to explore when looking for a fintech consulting firm. You can check some software development companies’ review platforms, such as Clutch or GoodFirm. They serve as a directory for consulting firms, insights, and client reviews.

Another way to find a fintech consulting firm is by networking within the industry. You can attend industry events, conferences, and seminars focused on specific financial technology you are interested in. It can provide opportunities to connect with professionals and advisors specializing in fintech.

Ultimately, financial institutions should prioritize finding top fintech consultants with expertise in fintech and a track record of successful projects. Collaborating with a qualified fintech consultant can help institutions navigate the complexities of financial technology, drive innovation, and achieve their business goals.

Reasons to choose devspiration

devspiration is one of the top fintech companies providing software development and consulting services. We have been working with innovative fintech for many years and have created a unique approach to consulting based on our own experience and knowledge.

So why should you choose us?

- We do not just advise but become your partner interested in the success of your business. Therefore, you get a dedicated team that perfectly understands payment, banking, and investment regulations, emerging technologies, flexible development methodologies, etc.

- Our portfolio of successful projects and client testimonials proves our extensive fintech expertise. Whether it is a wealth management application, open banking, analytical investment tools, process automation, or due diligence, we provide qualified fintech consulting services in a specific field.

- We favor open and transparent communication, so we always define the terms of cooperation and communication channels and pay attention to all client’s needs. You can book a demo call to discuss the financial technology that you are interested in and learn more about us.

For us, security is a top priority, especially when it comes to sensitive data in the field of financial services. Therefore, you can be sure that your data will be securely protected.

Wrapping Up

A proper fintech consulting partner is crucial for financial institutions looking to leverage the power of specific financial technology. It helps to create an efficient development strategy, choose the best tech stack and tools, get valuable industry insights, and, as a result, save money and time. Finding a fintech management consulting partner who can provide tailored solutions and drive innovation is essential.

Remember to prioritize expertise, background, fresh perspectives, niche specialization, and effective communication when selecting a fintech consultant. With a qualified advisor by your side, you can confidently navigate the complexities of the fintech landscape and achieve your business goals.

devspiration can become an excellent consultant in any matter of fintech. We will gladly share our expertise and help you find the best solution. Just contact us for more details.

FAQs

– What does a fintech consultant do?

A fintech consultant is a professional who provides specialized guidance and expertise in the field of financial technology. Fintech consultancy is about identifying growth and innovation opportunities, developing effective strategies, and offering insights on market trends, regulatory compliance, technological advancements, and customer expectations. They may assist with product development, digital transformation, risk management, business expansion, and other areas specific to fintech.

– How much do fintech consultants charge?

The cost of hiring a fintech consultant can vary depending on the consultant’s experience, scope of work, project complexity, etc. Fintech consultants may charge hourly, project-based fees or other options. The actual pricing may vary based on individual consultants and their specific services. You can contact us to discuss your project details and pricing.