Challenges of Cloud Adoption in Banking

Cloud computing for the banking industry has many challenges, as well as any other tech solution. By addressing them proactively and implementing appropriate strategies, banks can navigate the complexities of cloud adoption.

Legacy system integration

Banks can encounter challenges when integrating their existing legacy systems with cloud-based applications or migrating them to the cloud. They must be compatible with cloud environments and modifications. It is essential to plan the integration carefully and find proper specialists to avoid this issue to maintain data consistency, and seamless connectivity is essential.

Latency and performance challenge

The physical distance between a data center and a cloud service provider can contribute to latency problems. Delays in banking operations can adversely affect system performance, negatively impacting customer experience and satisfaction.

Banks must ensure the availability of reliable internet connectivity, establish failover mechanisms, and have contingency plans to prevent service interruptions and ensure continuous business operations.

Vendor lock-in and data portability

Banks need to consider the potential risk of vendor lock-in when adopting cloud services. It is crucial to assess the portability of data and applications between different cloud providers or back to on-premises environments if required. Banks should implement strategies to ensure data and application portability and minimize the possibility of being locked into a single provider.

Security concerns

Although cloud technologies provide many advanced security tools and measures, paying attention to this challenge is still critical. Storing and processing sensitive banking data with a third-party provider raises visibility issues and the potential for compromised credentials or data breaches.

However, reputable cloud service providers offer robust security capabilities. Banks should ensure that their chosen cloud service provider implements a strong identity management system with reliable access controls, as well as data privacy protocols and database security measures.

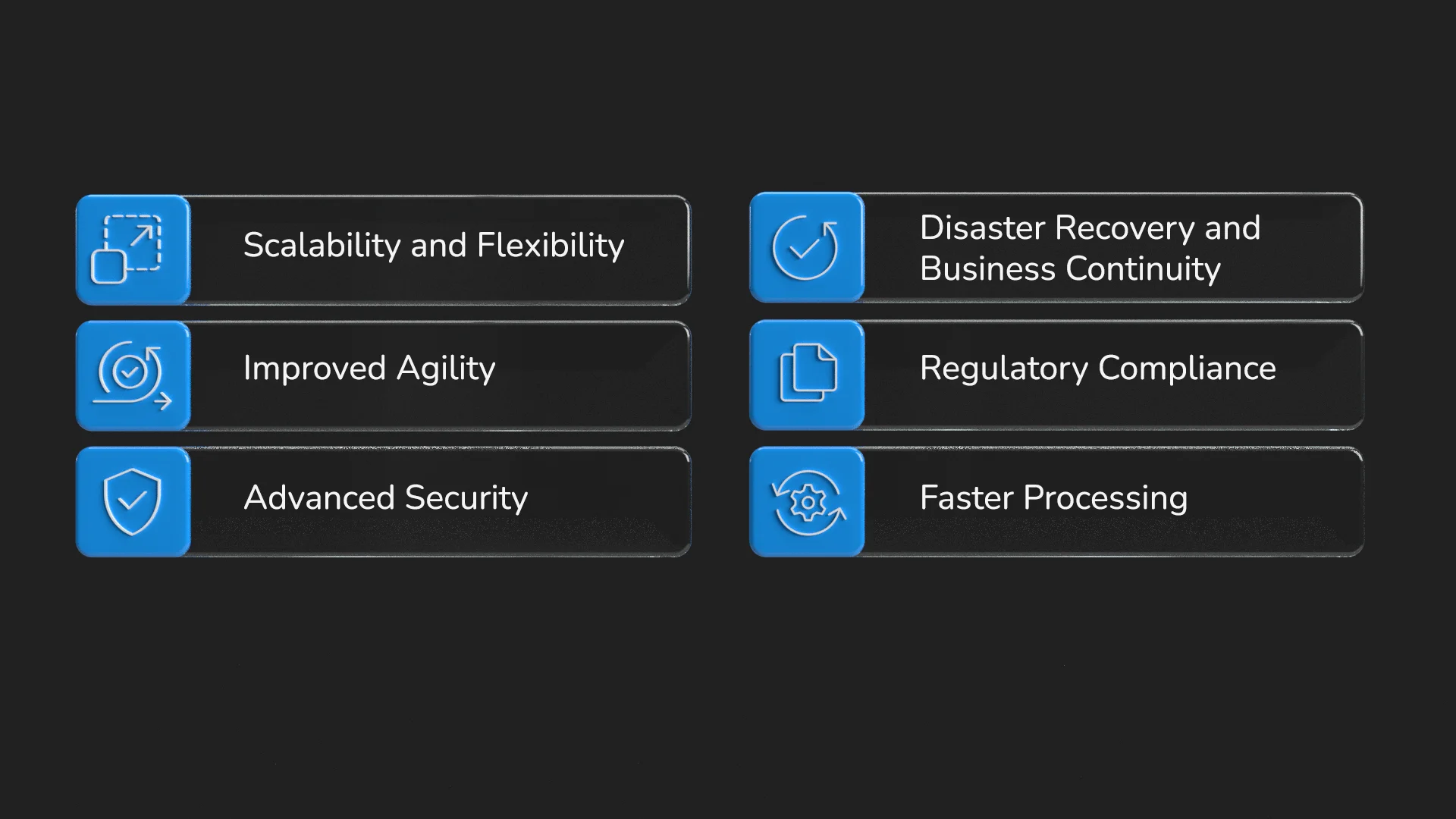

Accelerate Your Cloud Journey With devspiration

In capable hands, cloud computing in banking can unlock a lot of benefits, including scalability, cost efficiency, and enhanced agility. Whether you’re looking to optimize your infrastructure, streamline application development, or improve data security, our comprehensive suite of cloud services has got you covered.

At devspiration, we understand the unique challenges and opportunities of migrating to the cloud. Our team is well-versed in cloud architecture, deployment strategies, and best practices.

We will work closely with you to develop a tailored cloud roadmap that aligns with your business objectives and ensures a seamless transition.