Fintech API: Everything You Need To Know

12.09.2023

Find out how to choose the best fintech API and make the most of its possibilities. Explore fintech APIs' benefits and types and get valuable insights for your business.

The financial sector is a rapidly changing industry that requires very specific tech solutions and complex innovation. And one of the most illustrative examples of such solutions is fintech APIs. They are evolving along with financial products enabling seamless communication and data exchange.

In this article, we explore fintech APIs’ fundamentals, functionality, diverse types, and benefits. We also discuss how they facilitate the integration of bank accounts, payment networks, etc., into applications.

What Are Fintech APIs?

Fintech APIs, or application programming interfaces, are a set of protocols and tools that enable various software systems in the field of financial technologies to communicate and exchange data. They also define the rules, permissions, and limitations of such interactions.

Basically, fintech APIs are solutions that allow various organizations to integrate components of financial, banking, or other services into their applications. They are mediators between various software components.

In other words, API allows developers to

- ensure secure data exchange between parties involved in financial transactions (banks, web applications, third-party vendors, and customers);

- quickly and easily access financial data;

- to ensure seamless communication between various components for the smooth functioning of entire systems.

Modern fintech APIs can include different sets of features depending on their type and purpose. This provides not only wide functionality but also the ability to adapt to the requirements of fintech programs.

How Do Fintech APIs Work?

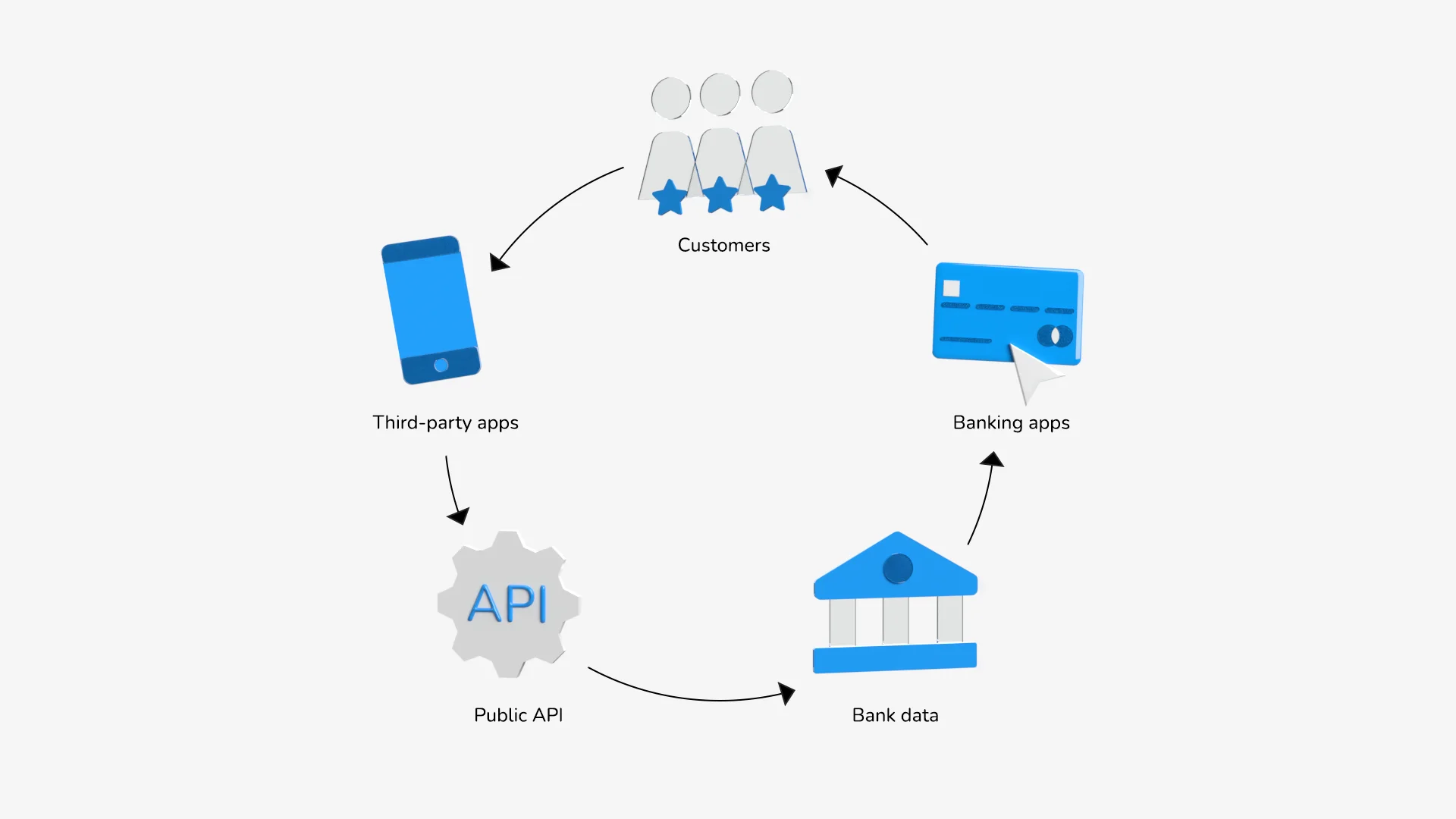

As we’ve already mentioned, fintech API enables different software applications to interact with each other and exchange data. Thanks to this, developers can easily integrate financial data and services into apps rather than having to build them from scratch.

Let’s go through the main steps.

- To use a fintech API, developers must first obtain an API key or authentication credentials from the API provider. This is the secure way to access API’s functionality and data.

- Once the developers have the necessary credentials, they can use the API to make a request for data or functionality. For example, they might use a payment API to process a user’s credit card payment.

- API calls to the provider’s server or other established endpoint over the Internet.

- The server processes the request, retrieves the necessary data, and sends it back to the requesting application. The developer can then use this data to provide new services or enhance existing ones.

As you can see, fintech APIs allow developers to quickly and easily add new financial functionality to their apps, in turn, makes it possible to provide a wide range of services to users.

How fintech APIs work: example

Most likely, you have already used an application programming interface without even knowing it. Financial institutions use this technology in the development of software for internal use as well as for client applications. In addition, apps from other fields also often integrate with API solutions.

When you place an order on the website, you can use the online payments system, which is integrated using the API. If you have used online banking at least once, you have also interacted with fintech APIs.

For example, you are a client of a certain bank and use a client application. It obviously has some functionality: bill payment, transaction history, balance check, real-time data updates, fraud prevention, etc. All these features can be provided by banking APIs. The app makes calls, connects to a server or other endpoint, and gets needed data or functionality.

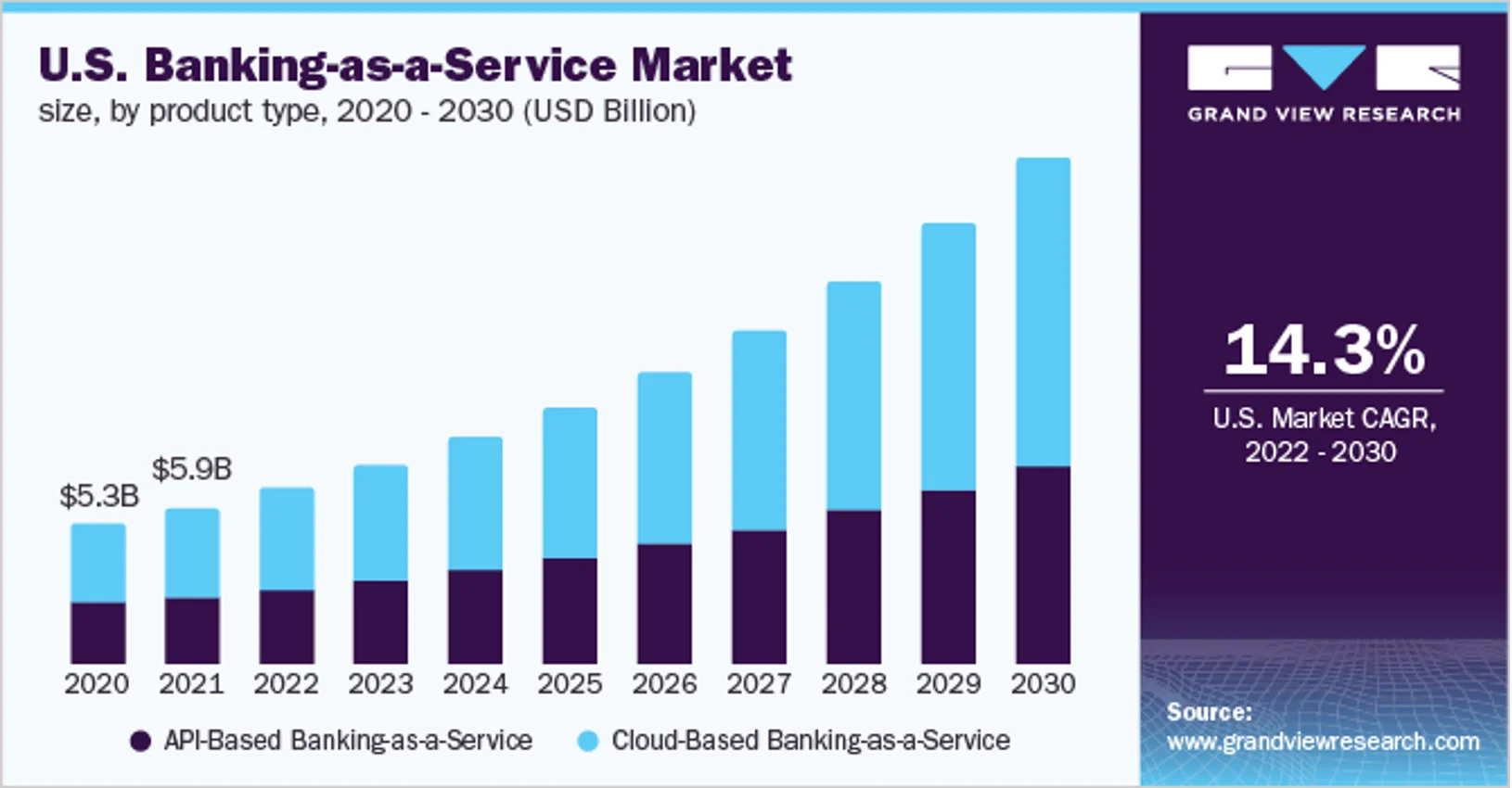

According to Grand View Research, the global Banking-As-A-Service market size is growing at a CAGR of 16.2%. And the main role in this was played by the development and availability of fintech APIs. So, as you can see, this technology is critical in the fintech and banking sector.

How APIs Benefit Fintechs

The first and foremost advantage of APIs in fintech is the ability to expand app functionality without developing features from scratch. This approach allows you to speed up product development, focus on core functionality and innovation, and meet user needs faster.

This actually allows you to add new quality features without spending too much time and money. However, there are a few other key benefits.

![]()

Flawless customer experience

Financial institutions’ services are often associated with routine and bureaucracy, and customers must fill out many forms, provide documents, etc. Modern APIs allow, if not to avoid this, then at least to make the process easier, faster, and more pleasant.

For example, APIs are the foundation of digital banking because they provide all the essential functionality, including identity verification, fraud detection, payment processing, etc., without the need to visit a bank office. Users can control bank accounts and get the full range of financial services with only a smartphone and access to the Internet.

This approach is also about a personalized experience and secure access to banking information.

Fraud prevention and security measures

Fintech APIs allow developers to use existing security infrastructure and implement advanced security features for user authentication, financial data storage, P2PE encryption, etc. For example, the KYC (Know Your Customer) API provides extensive opportunities for fraud prevention, detection and blocking illegal activities, ID verification, etc.

Compliance with regulatory requirements

The financial industry has strict regulatory requirements due to using a large amount of customer data and the need to control financial flows. And very often, compliance with such regulations is a concern, especially in the case of personal finance app development.

In this case, APIs help automate regulatory compliance by analyzing regulatory data, creating valid obligations to meet specific needs, and using advanced protections for sensitive data.

For example, you are developing a product in e-commerce or logistics. Your software should have an online payment feature, which is critical for today’s market. The system will process not only the personal data of users but also card data. And the product must meet the Payment Card Industry Data Security Standard or PCI DSS, financial data security guidelines for protecting user data.

Ready-made payment solution integrated through the API help to solve this issue. A payment gateway can already meet these requirements. Specific regtech APIs allow developers to comply with the European Payment Services Directive 2 (PSD2), which is especially relevant for the banking industry.

Cost efficiency

According to McKinsey research, in 2020, 75% of bank APIs were used for internal purposes, and banks plan to double their number within five years. At the same time, almost 20% of banking APIs are used externally to support integration with business partners and suppliers. The bottom line is that internal APIs significantly reduce development costs and complexity, freeing up capacity for changes by up to 30%.

This applies not only to the banking sector but also to the entire financial industry. The same survey shows that almost 90% of transactions today are carried out outside physical bank branches. That requires significant financial support and effort, and API solves this issue.

Considering all the previously mentioned advantages, including functional integration, regulatory compliance, etc., this technology is incredibly cost-effective. That is why it has become an integral part of the fintech industry.

Ready to unlock the potential of fintech APIs for your business? Book a call with our experts and discover how the fintech development services we provide can help you with this!

Types Of APIs You Can Use For Your Fintech App

There are many types of APIs that provide very different features. We will discuss the main ones.

Payment APIs

Such solutions allow you to integrate payment processing functionality into your application to securely process and manage online payments, invoices, etc. Here are the main advantages of such APIs.

- The ability to use the infrastructure of the existing payment platform for transaction control, user authentication, and fraud detection.

- A proper system for saving and protecting payment card data and other financial information.

- Automatic compliance with regulatory requirements such as PCI (Payment Card Industry Data Security Standard).

- Ability to use a fast and efficient payment processor and integrate local payment methods.

Also, some payment processing APIs may have tokenization and P2PE encryption features.

Banking APIs

Banking APIs are critical to improving banking services, accessibility, and profitability. In addition, they allow you to share data with third-party partners to implement innovations, obtain valuable analytical insights, expand your services, etc.

Such API integrations provide different functionality, including card management, balance checking, bill payment, money transfer, features to manage multiple accounts and control credit data, etc. In general, there are three main types of banking APIs.

Open Banking APIs

Partner APIs

Private APIs

Data providers and aggregator APIs

Such APIs in fintech allow banks to share data with third-party applications. This can be information about accounts and transactions, customer profile data, etc.

Data aggregator APIs are flexible and allow access to data from many banks. In this way, developers can combine several areas of services in one interface (lending, debt management, investments, etc.).

Identity verification APIs

Such solutions help to integrate user identification systems without developing additional functionality and security measures. They allow developers to perform such checks as KYC (Know Your Customer), KYB (Know Your Bank), AML (Anti-Money Laundering), etc. It is essential for maintaining regulatory compliance, not to mention the security protocols for financial transactions (digital footprint analysis, document verification, biometric verification, e-signature, etc.).

Companies can use them not only to verify users’ identity but also to monitor their actions, track behaviour, check payment sources, etc. It helps protect financial data and detect fraud or corruption. You can use APIs for all fintech startups, including mobile banking products.

RegTech APIs

The main goal of regtech as an industry is to help companies comply with regulatory requirements. Accordingly, regtech APIs provide full functionality for analyzing regulatory documentation, synthesizing it into obligations, automating audits and due diligence processes, tracking updates that may affect compliance, etc.

Need assistance in automating business processes? Read our due diligence automation case study and check our expertise.

Investment APIs

Such solutions enable integration with investment and trading platforms, including blockchain, as well as brokerage services. They can be used to access the functionality for obtaining rich stock data and investment analytics, execution and management of transactions, access investment portfolios, etc. These can be brokerage solutions, blockchain APIs, stock trading market APIs, etc.

Best FinTech APIs To Use

Everyone can name their own top APIs depending on their business needs, requirements, and desired functionality. We will consider versatile and most famous options in different directions.

Payment APIs

- Stripe. Supports credit and debit card payments and digital wallets like Apple Pay and Google Pay. Offers extensive functionality such as recurring billing, subscription management, fraud detection (Radar), etc.

- Square. Good choice for a personal finance app. Offers point-of-sale (POS) solutions and card readers for in-person transactions, various payment methods, including cards, digital wallets, cryptocurrencies, etc.

Banking APIs

- Plaid. Offers a comprehensive suite of APIs that provide access to banking data, including bank account information, transaction history, balances, etc.

- Basiq. Provides access to the financial data via single API, compliant with CDR (Consumer Data Rights), functionality for analyzing expenses, assets, and liabilities.

Data providers and aggregator APIs

- Mono. Provides access to financial accounts for bank statements, balances and credit info, historical transactions, etc.

- Belvo. Connects fintech applications (neobanks, personal finance products, etc.) with data from banks, tax authorities, etc.

Identity verification APIs

- Veriff. AI-powered identity verification solution for fraud prevention. Provide Know Your Customer compliance and tools for biometric authentication.

- HyperVerge. API platform for fraud checking, facial authentication, ID document and age verification, eKYC, etc.

RegTech APIs

- Ascent. AI-based regtech platform; generates a complete set of obligations targeted to specific businesses and updates them automatically.

- Apiax. Offers tools for transforming complex financial regulations into digital compliance rules, their updating and verifying.

Investment APIs

- YH Finance. Real-time finance API for currency exchange, stock market, cryptocurrencies, etc.

- Alpha Vantage. Stock market API; provides stock data APIs in JSON, Excel, or Google Sheets and offers more than 60 technical/economic indicators.

Future of APIs in Fintech

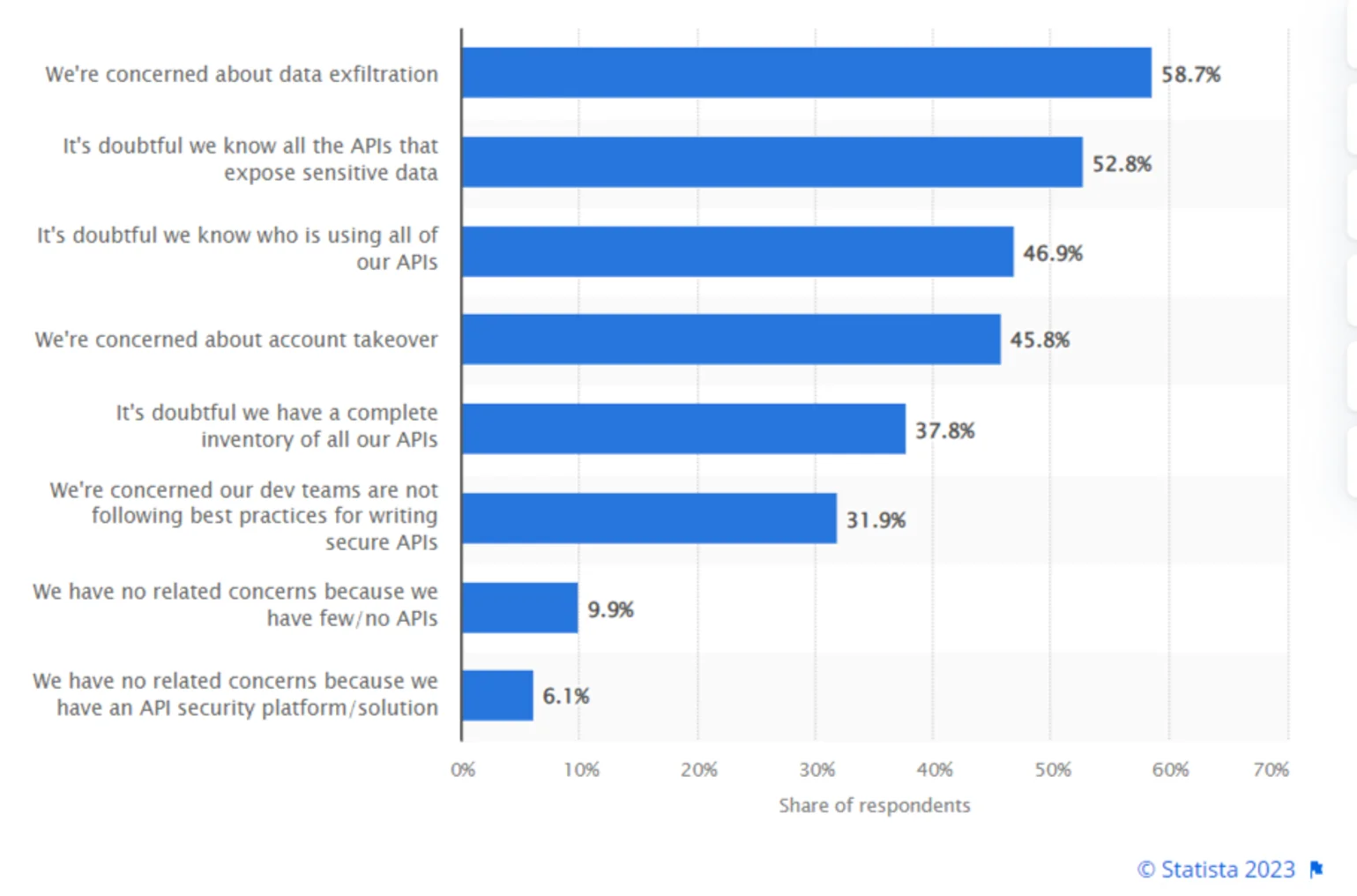

It is obvious that fintech APIs have become an important part of the development of software and personal apps. However, fintech companies have some concerns. According to the Statista survey, most organizations (58.7%) are concerned about the security of fintech APIs, namely the risks of data exfiltration.

That is why, in the future, developers will probably pay more attention to the security issues of such products, as well as the possibilities of custom software development to create APIs that would be tailored to specific business needs.

In addition, most of the popular APIs already interact with artificial intelligence and machine learning technologies in one way or another. The adoption of such solutions is inevitable not only for application interfaces but also for any fintech app in general.

Final Thoughts

Every fintech company goes through digital transformation no matter how many clients it has and what services it provides, and fintech APIs have emerged as critical tools for innovation and growth. They empower businesses to leverage financial technologies, seamlessly integrate with banking systems, and enhance the client experience. By utilizing this technology, companies can accelerate their development processes, reduce costs, and ensure compliance with regulatory requirements.

The future of fintech APIs holds huge potential. Besides focusing on security and customized solutions, developers will work towards creating tailored APIs that address specific business needs while protecting sensitive data. Furthermore, integrating artificial intelligence and machine learning technologies will further expand the capabilities of such solutions, enabling more intelligent and efficient financial services.

We at devspiration know precisely how to use APIs to revolutionize the financial sector, empower businesses to build advanced applications, and drive the digital transformation of the industry. And we will be pleased to share our expertise with you and provide your company with an experienced and well-educated development team. Feel free to contact us for more details.